Finance Minister Nirmala Sitharaman on Tuesday introduced a number of income tax reforms in the Union Budget 2024-25, aimed at simplifying tax laws, promoting compliance, and supporting economic growth.

Sitharaman tweaked the new tax regime by revising personal income tax slabs.

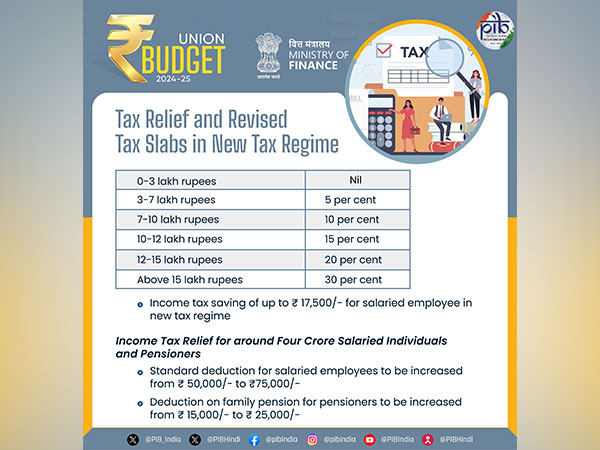

Earlier, those with a taxable income between Rs 3-6 lakh paid income tax at a rate of 5%. The Finance Minister announced a change in this slab, extending it to Rs 3-7 lakh. Similarly, the slab for the 10% tax rate has been revised from Rs 6-9 lakh to Rs 7-10 lakh. The tax slab for the 15% rate has also been updated, shifting from Rs 9-12 lakh to Rs 10-12 lakh.

Tax rates for income between Rs 12-15 lakh will remain at 20%, and income above Rs 15 lakh will continue to be taxed at 30%.

The Finance Minister also increased the standard deduction from Rs 50,000 to Rs 75,000. Additionally, the deduction on family pensions has been raised from Rs 15,000 to Rs 25,000 under the new tax regime.

Further measures include an increase in the pension scheme contribution deduction by an employer under Section 80CCD, from 10% to 14% of the employee’s salary for non-government employees.

The finance minister merged existing tax exemption regimes for charities, reduced the TDS rate for e-commerce operators from 1% to 0.1%, and allowed TCS credit against TDS deducted on salaries.

The government also announced simplifications in tax administration with revised procedures for reopening and reassessment, rationalized SOPs for TDS defaults, and updated compounding guidelines.

A simpler tax regime for foreign shipping companies operating domestic cruises was introduced. Additionally, income generated from buybacks will now be taxed. The penalty for non-reporting of movable assets valued at Rs 20 lakh is being removed, and the equalization levy on digital transactions is withdrawn.

Sitharaman highlighted that the simplified corporate tax regime now accounts for 58% of corporate tax revenue for 2022-23. She pointed out that two-thirds of personal tax filers are opting for the new tax regime. The government is also working on a comprehensive review of the Income Tax Act, which is set to be completed in the next six months.