China’s economy is facing increasing external uncertainties and many domestic difficulties and challenges in the second half, a spokesperson for the National Bureau of Statistics said on Monday. China’s GDP growth of 5% in the first half was “hard won” as businesses face relatively large pressures and key sectors face many risks, the spokesperson said in a statement published on the bureau’s website.

The spokesperson also said China’s economic growth in the second quarter was affected by short-term factors such as extreme weather and flooding. China’s economy grew much slower than expected in the second quarter, as a protracted property downturn and job insecurity squeezed domestic demand, keeping alive expectations Beijing will need to unleash even more stimulus.

The world’s second-largest economy grew 4.7% in April-June, official data showed, its slowest since the first quarter of 2023 and missing a 5.1% analysts’ forecast in a Reuters poll. It was also down from the 5.3% expansion in the previous quarter.

“Overall, the disappointing GDP data shows that the road to hitting the 5% growth target remains challenging,” said Lynn Song, chief economist for Greater China at ING.

“A negative wealth effect from falling property and stock prices, as well as low wage growth amid various industries’ cost cutting is dragging consumption and causing a pivot from big ticket purchases toward basic ‘eat, drink and play’ theme consumption,” he added. In the meantime, China’s yuan and stocks fell following the disappointing data.

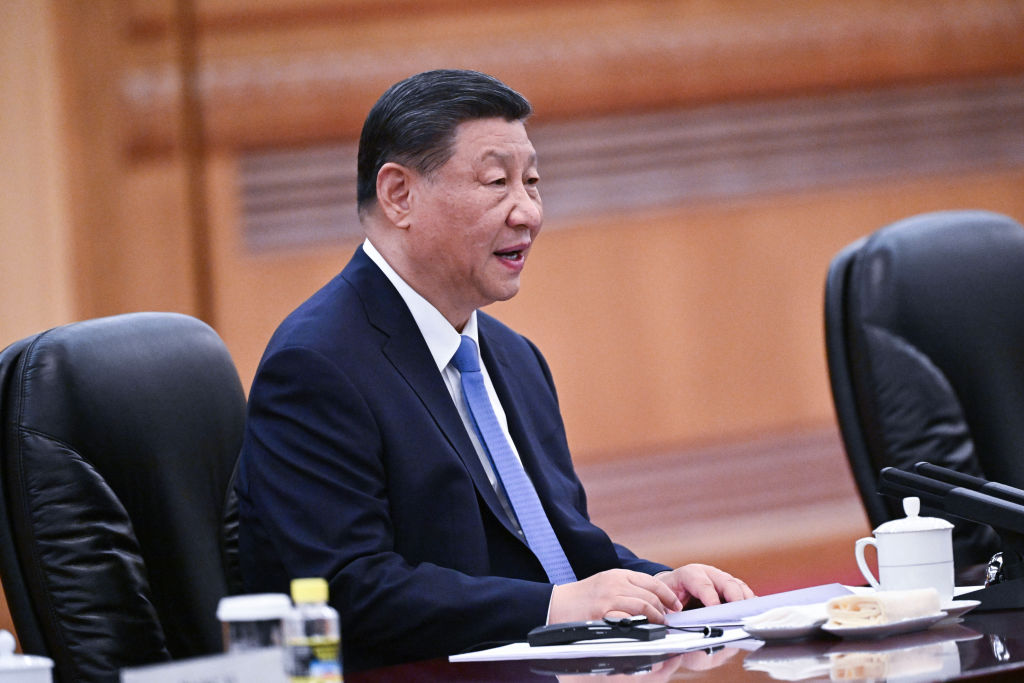

The figures come as Beijing seeks to shore up economic confidence at a highly anticipated third plenum, a key leadership meeting that starts Monday, although conflicting requirements such as boosting growth and cutting debt complicate those plans.

The government is aiming for economic growth of around 5.0% for 2024, a target that many analysts believe is ambitious and may require more stimulus. On a quarterly basis, growth came in at 0.7% from a downwardly revised 1.5% in the previous three months. To counter soft domestic demand and a property crisis, China has boosted infrastructure investment and ploughed funds into high-tech manufacturing.

China’s National Bureau of Statistics said while bad weather accounted for some of the hit to growth in the second quarter, the economy faced increasing external uncertainties and domestic difficulties in the second half of this year.

Economic growth in China has been uneven with industrial output outstripping domestic consumption, fanning deflationary risks amid the property downturn and mounting local government debt. While solid Chinese exports have provided some support, rising trade tensions now pose a threat.

Broadly reflecting those trends, separate date on Monday showed factory output growth beating expectations in June but still slowing from May while retail sales growth also missed forecasts.

That follows data released earlier this month that showed China’s exports up 8.6% in June from a year earlier, and imports unexpectedly shrinking 2.3%, suggesting manufacturers are frontloading orders to get ahead of tariffs from trade partners. Consumer prices, meanwhile, also missed expectations and factory deflation persisted.

“Among all the monthly figures released today, the highlight is the weak retail sales,” said Xing Zhaopeng, senior China strategist at ANZ. Retail sales grew 2.0% year-on-year in June, missing the 3.3% growth forecast in the poll. “Household consumption remains very week… with employers slashing salaries and high youth unemployment, households will still be cautious going forward,” Xing added.

There was even more pain in China’s battered property sector with new home prices falling at the fastest pace in nine years in June and struggling to find a bottom despite government support measures. Property investment fell 10.1% in the first half of 2024 from a year earlier, and home sales by floor area fell 19.0%, deeper than a 20.3% slump in the first five months of the year.

China’s central bank governor Pan Gongsheng last month pledged to stick to a supportive monetary policy stance. Analysts polled by Reuters expect a 10-basis points cut in China’s one-year loan prime rate as well as a 25-basis points cut in banks’ reserve requirement ratio in the third quarter.

Citi analysts expect the government to unleash another round of property-supporting measures after a meeting of the Politburo, a top decision-making of the ruling Communist Party expected in late July.

Authorities in May allowed local state-owned enterprises to buy unsold completed homes, with the central bank setting up a 300 billion yuan relending loan facility for affordable housing. (Reuters)