The value of digital payments surged to ₹1,669 lakh crore in the first five months (April-August) of the current financial year 2024-25, according to the Union Finance Ministry.

The ministry reported that the transaction volume of digital payments reached 8,659 crore during the same period. The value of UPI transactions has grown from ₹1 lakh crore to ₹200 lakh crore at a CAGR of 138%. Additionally, in the last five months (April-August FY 2024-25), the total transaction value surged to an impressive ₹101 lakh crore.

In a statement on Friday, the Ministry of Finance highlighted that digital payments in India have witnessed significant growth, with the total number of digital payment transactions increasing from 2,071 crore in FY 2017-18 to 18,737 crore in FY 2023-24, at a compound annual growth rate (CAGR) of 44%.

“During the last five months (April-August) of the current financial year 2024-25, the transaction volume has reached 8,659 crore. The value of transactions has grown from ₹1,962 lakh crore to ₹3,659 lakh crore at a CAGR of 11%. Additionally, in the last five months (April-August) of the current financial year 2024-25, the total transaction value has surged to an impressive ₹1,669 lakh crore,” the ministry said.

The ministry also emphasized that UPI remains the cornerstone of India’s digital payment ecosystem. UPI transactions have grown from 92 crore in FY 2017-18 to 13,116 crore in FY 2023-24, with a CAGR of 129%.

The Finance Ministry underscored that efforts to accelerate the adoption of fast payment systems like UPI have transformed financial transactions, enabling real-time, secure, and seamless payments for millions.

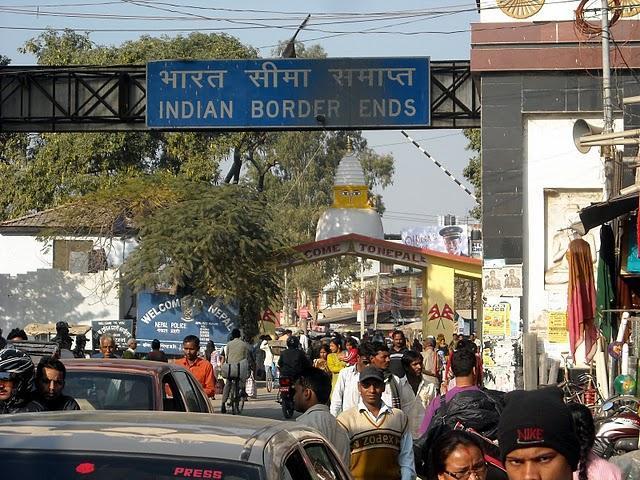

Highlighting India’s digital payment expansion globally, the ministry stated that both UPI and RuPay are rapidly expanding, facilitating seamless cross-border transactions for Indians living and traveling abroad.

Currently, UPI is live in seven countries, including key markets such as the UAE, Singapore, Bhutan, Nepal, Sri Lanka, France, and Mauritius, allowing Indian consumers and businesses to make and receive international payments. The ministry added that this expansion will bolster remittance flows, improve financial inclusion, and enhance India’s standing in the global financial landscape.