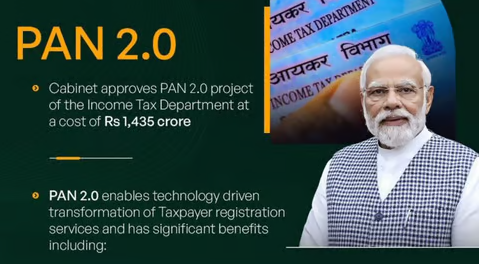

In a bid to modernize India’s financial ecosystem, the Ministry of Finance has unveiled PAN 2.0, a transformative upgrade to the Permanent Account Number (PAN) system. The initiative aims to simplify taxpayer services while enhancing efficiency and security, aligning with the government’s Digital India vision.

The Cabinet has approved a Rs 1,435 crore budget for the PAN 2.0 Project, which reimagines how PAN and TAN (Tax Deduction and Collection Account Number) services are offered. By consolidating processes under a single platform and adopting eco-friendly, paperless workflows, the initiative is set to redefine financial administration.

Key Features of PAN 2.0

Unified Digital Platform:

Currently spread across multiple portals, PAN/TAN-related services will now be accessible through a single, unified portal managed by the Income Tax Department. This platform will handle allotment, updates, corrections, Aadhaar-PAN linking, and other essential functions.

Paperless and Free Services:

The upgraded system introduces paperless processes and free e-PAN services. Taxpayers can obtain their e-PAN via email at no cost, while physical PAN cards will be available for a nominal fee.

Enhanced Security:

A new PAN Data Vault will safeguard personal and demographic information. Additionally, the system will employ advanced mechanisms to detect and prevent duplicate PAN issuance.

Dedicated Support:

The project includes a dedicated call center and helpdesk to resolve user queries, improving taxpayer convenience.

QR Code Enhancements

The QR code feature, first introduced in 2017-18, has been upgraded to display dynamic data, ensuring real-time verification of PAN details. Taxpayers with older cards can opt for updated versions featuring the new QR code.

Global Standards and Certifications

PAN 2.0 adheres to international standards for data security and service quality, including ISO certifications. These measures enhance the credibility and reliability of the system while ensuring seamless user experiences.

Simplified Access for Taxpayers

Existing PAN cardholders are not required to apply for a new card. However, they can request updates or corrections as needed. The system also facilitates easy TAN issuance, vital for entities responsible for tax deduction and collection.

Compliance and Penalties

The Income Tax Act mandates PAN for individuals earning above the taxable income limit, businesses exceeding ₹5 lakh in annual turnover, and certain financial transactions. Non-compliance or possession of multiple PANs can result in penalties of up to ₹10,000.

The PAN 2.0 initiative marks a monumental step in digital governance, streamlining taxpayer services while bolstering financial transparency. By adopting cutting-edge technology and global best practices, the government aims to create a robust, user-friendly system that simplifies compliance and strengthens India’s digital economy.