This surge in revenue can be attributed to a robust 13.9% rise in GST from domestic transactions and an 8.5% increase in GST from the import of goods. Furthermore, the GST revenue, net of refunds, for February 2024 stands at ₹1.51 lakh crore, showcasing a remarkable growth of 13.6% over the corresponding period last year.

Strong Performance Throughout FY 2023-24

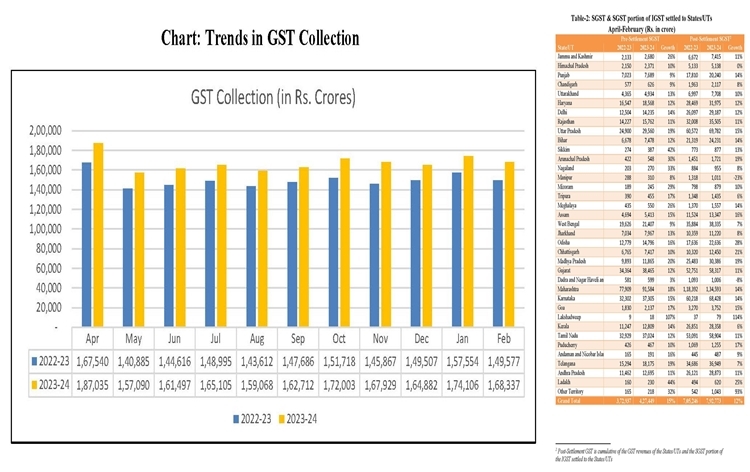

The fiscal year 2023-24 has witnessed consistent performance in terms of GST collection. As of February 2024, the total gross GST collection for the current fiscal year amounts to ₹18.40 lakh crore, demonstrating an impressive growth rate of 11.7% compared to the same period in FY 2022-23. Notably, the average monthly gross collection for FY 2023-24 has surpassed ₹1.5 lakh crore, standing at ₹1.67 lakh crore. This surpasses the collection recorded in the corresponding period of the previous fiscal year.

The net GST revenue, post refunds, for the current fiscal year as of February 2024 is ₹16.36 lakh crore, showcasing a commendable growth rate of 13.0% over the same period last year.

Breakdown of February 2024 Collections

– Central Goods and Services Tax (CGST): ₹31,785 crore

– State Goods and Services Tax (SGST): ₹39,615 crore

– Integrated Goods and Services Tax (IGST): ₹84,098 crore, including ₹38,593 crore collected on imported goods

– Cess: ₹12,839 crore, including ₹984 crore collected on imported goods

Inter-Governmental Settlement

The central government has settled ₹41,856 crore to CGST and ₹35,953 crore to SGST from the IGST collected. This results in a total revenue of ₹73,641 crore for CGST and ₹75,569 crore for SGST after regular settlement.

The consistent growth in GST revenue is indicative of the resilience and robustness of the Indian economy, despite global uncertainties. It reflects the effective implementation of GST policies and the buoyancy of economic activities across various sectors.