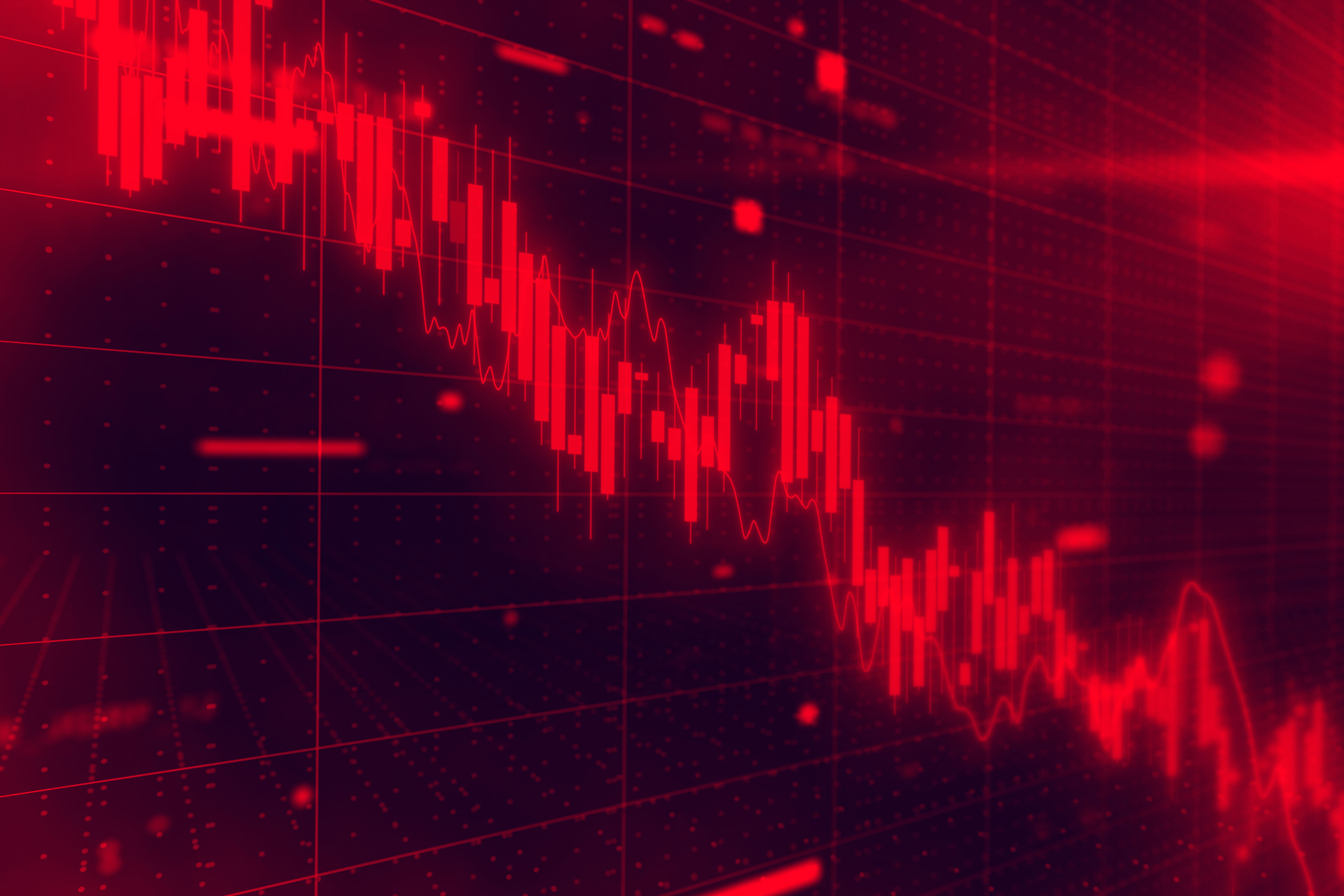

Indian equity markets fell on Monday, influenced by global trends and uncertainties regarding US trade policies.

The BSE Sensex dropped 824 points or 1.08%, closing at 75,366. The NSE Nifty50 declined by 263 points or 1.14% to end at 22,829.

On the Sensex, six stocks closed higher. ICICI Bank led the gainers with a 1.75% increase, followed by SBI, Hindustan Unilever, Asian Paints, UltraTech Cement, and Maruti Suzuki India. Zomato, Tech Mahindra, HCLTech, and Tata Motors were among the stocks that declined.

In the Nifty50, 10 stocks recorded gains. Britannia Industries rose 1.93%, followed by ICICI Bank, Hindustan Unilever, Larsen & Toubro, and Nestle India. Bharat Electronics Limited (BEL) dropped 2.68%, along with losses in HCLTech, JSW Steel, and Trent.

Sectoral indices showed mixed performances. The Media index fell by 3.83%, the Pharma index declined by 2.35%, and the IT index shed 2.19%. The PSU Bank index closed with a marginal gain of 0.12%.

Broader markets witnessed sharper declines. The Nifty Midcap 100 lost 2.25%, while the Nifty Smallcap 100 declined by 3.51%.

According to Rupak De of LKP Securities, the index slipped from its recent consolidation on the daily chart, heightening pessimism across the Indian equity market. “Sentiment is likely to favour bearish trades in the short term, particularly as long as the index remains below 23,000. On the lower side, the prevailing weakness could potentially lead to a decline toward 22,500,” he said.

In Asian markets, responses were mixed. The Hang Seng Tech Index in Hong Kong rose by 2%, while Japan’s Nikkei 225 futures dropped by 0.6%.

India’s volatility index (VIX) rose 7.36% to 17.98.

Gold prices saw some movement, with Comex gold facing resistance near $2,770 and support around $2,750.

— IANS