July 12, 2024 9:07 PM

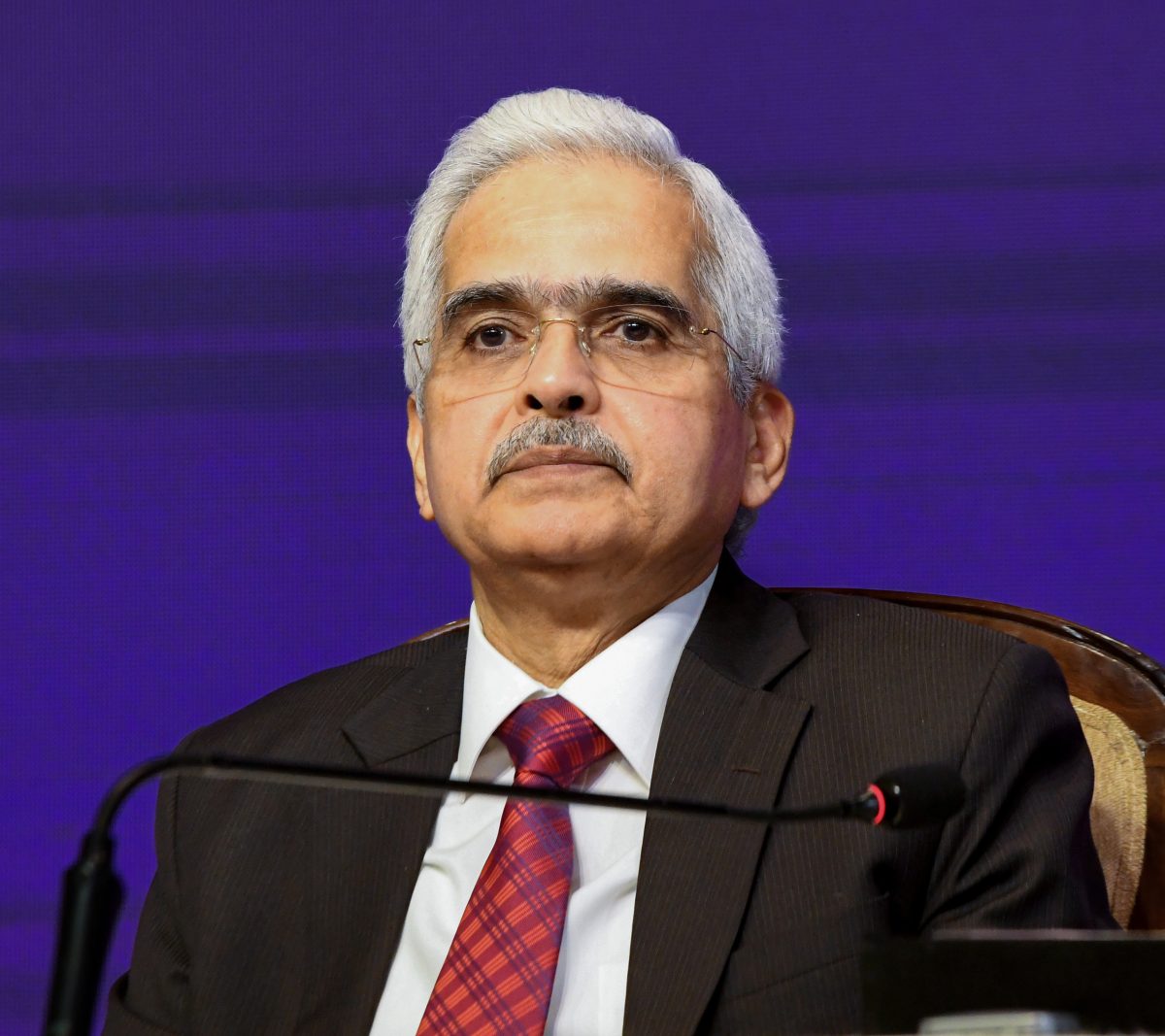

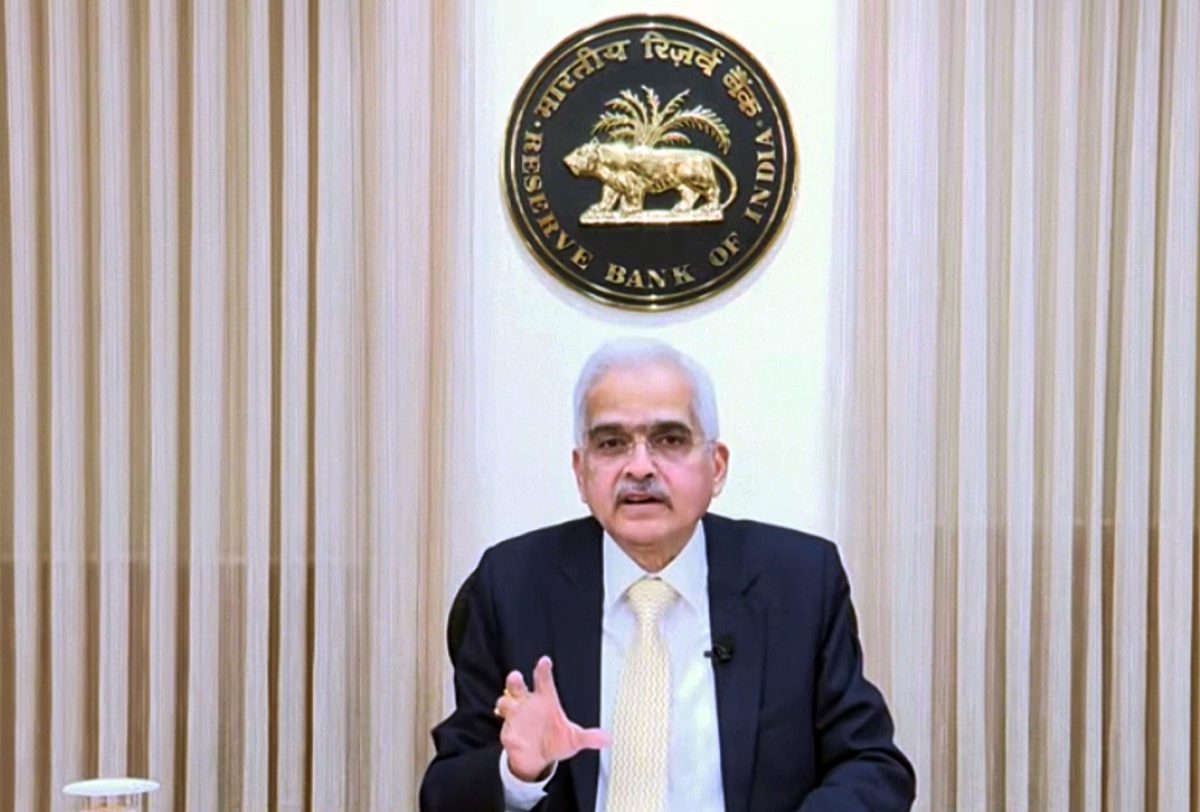

India’s foreign exchange reserves hit record high of $657.2 billion

The Reserve Bank of India (RBI) reported on Friday that for the week ending July 5, the nation's forex reserves surged by $5.158 billion, touching an unprecedented $657.155 billion. This figure surpasses the previous record of $655.817 billion set just last month. The steady climb of India's forex reserves has been a consistent trend in 2024, with a cumulative increase of approximately $35 billion since the year's start. Breaking down the components, India's foreign currency assets (FCA), the ...