April 8, 2025 4:35 PM

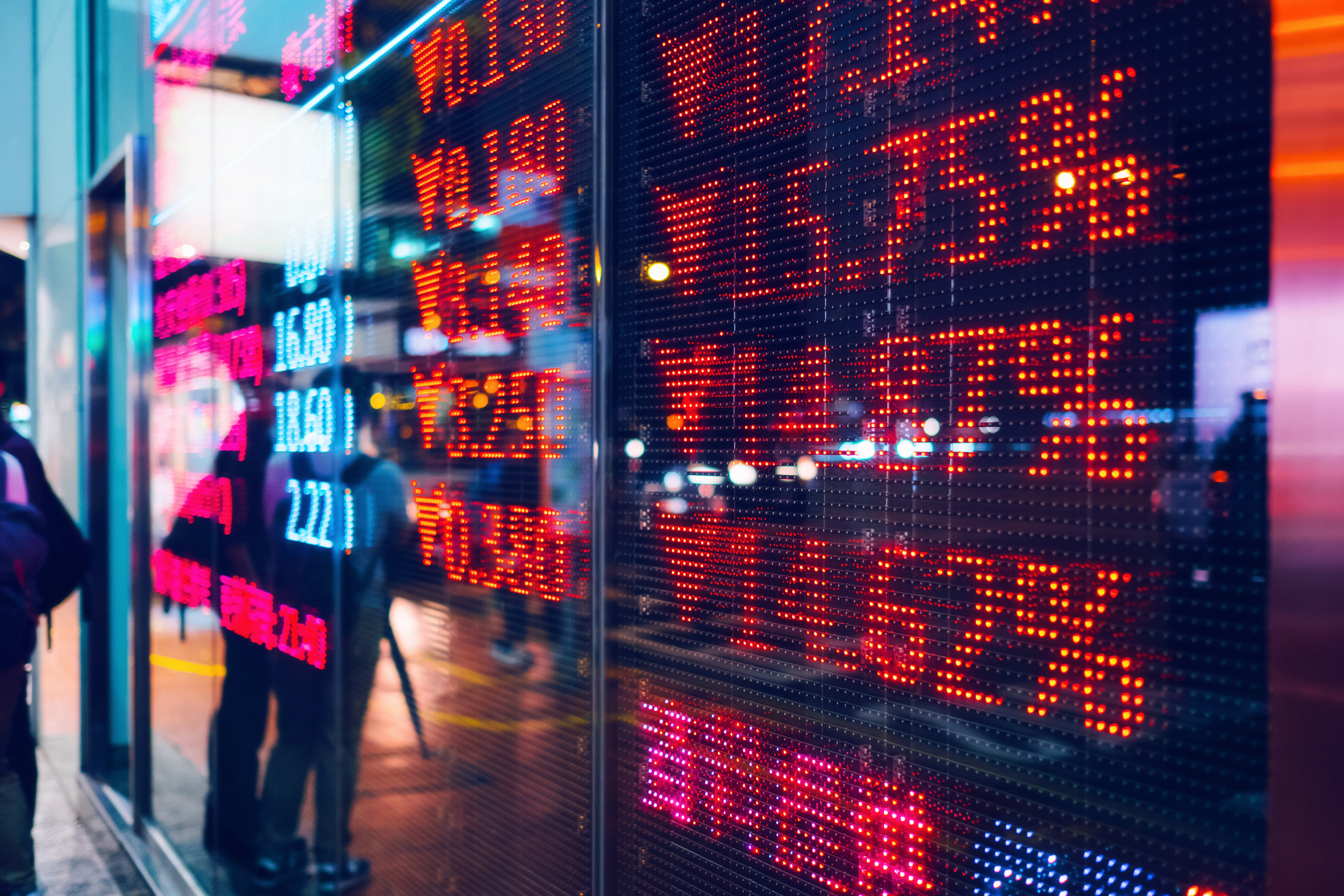

Sensex, Nifty see strong relief rally ahead of key RBI MPC decision

Indian stock markets staged a robust relief rally on Tuesday, snapping a three-day losing streak ahead of the Reserve Bank of India's (RBI) monetary policy decision on April 9. Both the Sensex and Nifty rose sharply, each gaining around 1.5 per cent by the end of the day as investors brushed aside concerns over US tariff threats. The Sensex jumped 1,089 points, or 1.49 per cent, to close at 74,227.08, while the Nifty climbed 374 points, or 1.69 per cent, to settle at 22,535.85. The rebound ca...