India’s welfare system has undergone a profound transformation in recent years as technology has been channeled to manage long-standing challenges such as bureaucratic inefficiencies, administrative leakages, and corruption. For decades, social assistance programs—whether in the form of cash or in-kind transfers—suffered from complex processes and significant fund losses, with studies revealing that out of every 1 rupee allocated, only about 15 paisa reached the intended beneficiary.

This inefficiency was particularly striking given that India dedicates nearly 3%-4% of its GDP to subsidies (Economic Survey, 2017-18) and social support programs aimed at uplifting its citizens. However, systemic challenges in effectively identifying the true beneficiaries, coupled with delays in delivery, result in a significant loss of resources—equivalent to nearly half (Policy Paper, National Institute of Public Finance and Policy) of these allocated funds each year.

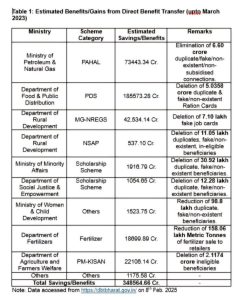

In response, the government introduced the Direct Benefit Transfer (DBT) system in 2013, a transformative initiative aimed at delivering benefits directly to citizens’ bank accounts while minimizing human intervention (Table 1: An estimated gain of about ₹3,48,564.66 crore as per the data available on https://dbtbharat.gov.in/; as accessed on 08-02-2025). The DBT framework is built on the robust ‘JAM’ trinity of Jan Dhan Yojana, Aadhaar, and mobile connectivity.

This integrated system has enabled the direct crediting of subsidies and benefits into beneficiaries’ bank accounts, dramatically reducing the scope for corruption and administrative mismanagement. With the digitalization of beneficiary databases, the government has effectively weeded out ghost accounts and reduced duplications, ensuring proper resource allocation (Table 1).

Financial inclusion received a significant boost with the launch of the Jan Dhan Yojana in 2014, which, coupled with the exponential increase in mobile connectivity, laid the groundwork for the rapid expansion of the DBT system. Central to this digital revolution is the Aadhaar system, launched in 2009 and now recognized as the largest biometric identity program in the world. By streamlining the verification process and eliminating duplicate records, Aadhaar has been instrumental in ensuring that social assistance reaches the correct beneficiaries.

Previously, complex documentation requirements and multiple forms of identification for various schemes created obstacles for efficient service delivery. With Aadhaar now linked to programs such as the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS), ration cards, and other social welfare initiatives, the process has become far more coherent and targeted. As of 14th August 2024, over 53 crore Jan Dhan accounts had been opened (https://pib.gov.in/PressReleasePage.aspx?PRID=2049231), addressing the critical issue of an unbanked population.

The surge in mobile phone usage, evidenced by an increase in teledensity from 68.64% in 2013 to approximately 85.4% on 31st August 2024 (https://pib.gov.in/PressReleaseIframePage.aspx?PRID=2068372), further highlights the effectiveness of the ‘JAM’ approach. By linking Aadhaar with bank accounts and mobile phones, the government has created a seamless infrastructure that underpins the DBT mechanism.

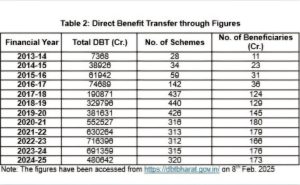

The technical process of DBT involves Aadhaar-based authentication—using demographic data, one-time passwords, or biometric verification—to map beneficiaries’ details to their bank accounts via the Aadhaar Payment Bridge of the National Payments Corporation of India (NPCI). Since its initial rollout covering 28 schemes in 2013-14, the DBT mission has expanded dramatically, now encompassing over 320 schemes (Table 2).

The total funds transferred have surged from approximately ₹7,300 crore to ₹6,91,300 crore in 2023-24, and the number of beneficiaries has grown from 11 crore to nearly 176 crore over the same period (Table 2). During the COVID-19 pandemic, the system’s scalability was particularly evident, as beneficiary coverage increased from 145 crore in FY2019-20 to 180 crore in FY2020-21, emphasizing the infrastructure’s capacity to adapt rapidly to emergent needs.

The evolution of DBT has been marked by its expanding scope, beginning with student scholarships and support for women, children, and workers, and gradually incorporating a diverse array of welfare schemes. MGNREGS, which guarantees at least 100 days of manual labor at notified wages, generally suffered from significant wage payment delays due to cumbersome processes.

The introduction of the Aadhaar-Based Payment System (ABPS) under DBT has dramatically improved payment timelines, with timely payment disbursements rising from 50.09% in 2012-13 to over 98% by 2024-25 (https://nreganarep.nic.in/netnrega/MISreport4.aspx).

Beyond direct cash transfers, Aadhaar has enabled access to a range of critical services. In the healthcare sector, for instance, the Ayushman Bharat-Pradhan Mantri Jan Aarogya Yojana (PMJAY) employs Aadhaar-based eKYC to facilitate a paperless process for cashless hospitalization benefits, while the ‘One Nation One Ration Card’ initiative has leveraged electronic point-of-sale devices and biometric scanners to ensure that subsidized food grains are accessible nationwide.

Moreover, Aadhaar serves as a universal identifier that integrates various government databases, such as those for unorganized workers—via the e-Shram portal—and for senior citizens, who can now generate a digital life certificate through Aadhaar-based biometric authentication using applications like Jeevan Praman.

The far-reaching impact of these technological advancements is evident in the diverse range of beneficiaries served. Women have gained enhanced support through schemes such as the Pradhan Mantri Matru Vandana Yojana (PMMVY) and LPG gas subsidies, while educational initiatives have provided scholarships worth ₹8,584 crore to around 50 lakh students in FY2023.

Similarly, social assistance programs like the National Social Assistance Programme (NSAP) have extended benefits amounting to ₹3,546 crore to over 3.81 crore citizens, including the elderly, widowed, and persons with disabilities. The creation of more than 30 crore e-Shram cards as on date has enriched the understanding of the unorganized workforce (https://eshram.gov.in/indexmain), and initiatives like the Digital Health ID under the Ayushman Bharat Digital Health Mission empower every citizen to build a comprehensive digital health footprint through secure Aadhaar-based authentication.

Conclusion

Since 2014, India’s welfare system has seen notable changes, a true testament to the government’s committed efforts to improve governance and ensure financial inclusion. By integrating technology, including the mass adoption of Aadhaar, an expansion in mobile services, and the community-driven Jan Dhan Yojana, the government has redesigned how social benefits are distributed.

Central to this transformation is the Direct Benefit Transfer (DBT) system, supported by the powerful JAM trinity. This approach has drastically minimized the loss of funds due to leakage and mismanagement, guaranteeing that more resources reach the people they are meant to benefit.

The move towards a digital-first welfare system demonstrates a forward-thinking strategy where technology and evidence-based policies work together to enhance transparency, inclusivity, and timeliness in public services.

(Dr Shakil Bhat is a renowned researcher and expert in animal genetics, molecular biology, and breeding and has worked as a senior research fellow at Sher-e-Kashmir University of Agricultural Sciences and Technology (SKUAST), Kashmir)