The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) meeting, held from August 6 to 8, was marked by careful deliberation on inflation and growth challenges. The committee decided to keep the policy repo rate unchanged at 6.5%, maintaining its stance on the withdrawal of accommodation.

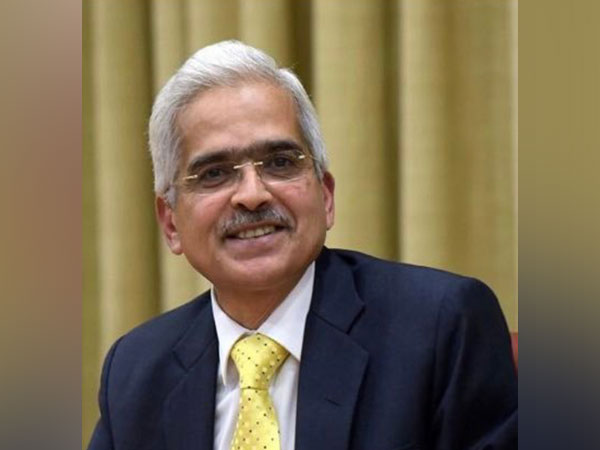

RBI Governor Shaktikanta Das highlighted the ongoing challenges in controlling inflation. He noted that while inflation is gradually decreasing, the process is slow and uneven. Persistent food inflation is contributing to the overall stickiness in headline inflation, making it difficult to achieve the target of 4%. Das stressed the importance of keeping inflation expectations anchored to prevent food inflation from spilling over into core inflation. At this critical juncture, stable growth allows monetary policy to focus on reducing inflation to the target. Das voted to maintain the policy repo rate at 6.5% and continue with the current stance.

Deputy Governor Dr. Michael Debabrata Patra expressed concern about the growing gap between headline and food inflation. He noted that this gap is hindering the alignment of headline inflation with its target. Patra reiterated the MPC’s commitment to achieving the inflation target, warning that any deviation could undermine the Indian economy’s prospects. He supported the decision to keep the policy rate and the current stance unchanged.

Dr. Rajiv Ranjan, another MPC member, observed that while global economic risks have increased, India’s domestic economy remains resilient. However, he acknowledged that inflation risks are currently higher than those related to growth. Ranjan argued that resilient growth provides the space to focus on inflation, maintaining the current policy stance until some risks are mitigated.

Prof. Jayanth R. Varma expressed concerns about the restrictive nature of the current monetary policy and its impact on growth. He pointed out that the RBI’s inflation projections indicate a downward trend, with inflation expected to reach 4.4% by the first quarter of 2025-26. Varma argued that the current repo rate of 6.5% is higher than necessary to achieve the inflation target of 4%.

Dr. Ashima Goyal shared Varma’s concerns and advocated for a 25 basis points cut in the repo rate, suggesting a shift to a neutral stance. She pointed to global uncertainties, including the possibility of a rate cut by the U.S. Federal Reserve. Goyal also noted that market rates in India were already declining as liquidity improved with government spending. She stressed the need for adequate liquidity alongside prudent policies to create positive incentives for the financial sector.

Dr. Shashanka Bhide, another MPC member, supported the decision to keep the policy repo rate unchanged at 6.5%. He noted that persistent food inflation might require core inflation to soften to maintain the headline inflation close to the target. Bhide warned that high food inflation could negatively impact growth by affecting consumption, necessitating restrictive monetary policies to soften core inflation.

(ANI)