India’s foreign exchange reserves witnessed a significant rebound, rising by $3.668 billion to $641.590 billion in the week ended May 3, according to data released by the Reserve Bank of India (RBI). This increase comes after three consecutive weeks of decline.

Prior to the reporting period, the country’s forex reserves had declined for three straight weeks, following a seven-week streak of growth that propelled them to an all-time high of $648.562 billion.

The latest RBI data reveals that India’s foreign currency assets (FCA), the largest component of the forex reserves, increased by $4.459 billion to $564.161 billion. However, the gold reserves witnessed a decline of $653 billion, settling at $54.880 billion.

India’s foreign exchange reserves, which have reached record highs, are sufficient to cover 11 months of projected imports, as stated in the Monthly Economic Review report of the Department of Economic Affairs under the Ministry of Finance, released recently.

In the calendar year 2023, the RBI has added around $58 billion to its foreign exchange reserves. In contrast, India’s forex kitty slumped by $71 billion cumulatively in 2022. So far in 2024, foreign exchange reserves have risen by over $20 billion on a cumulative basis.

Foreign exchange reserves, or forex reserves, are assets held by a nation’s central bank or monetary authority, typically in reserve currencies such as the US Dollar, Euro, Japanese Yen, and Pound Sterling.

India’s forex reserves last touched their all-time high in October 2021. Much of the decline after that can be attributed to a rise in the cost of imported goods in 2022. Additionally, the relative fall in forex reserves could be linked to the RBI’s intervention in the market from time to time to prevent an uneven depreciation of the rupee against the surging US dollar.

Typically, the RBI, from time to time, intervenes in the market through liquidity management, including through the sale of dollars, to prevent a steep depreciation in the rupee.

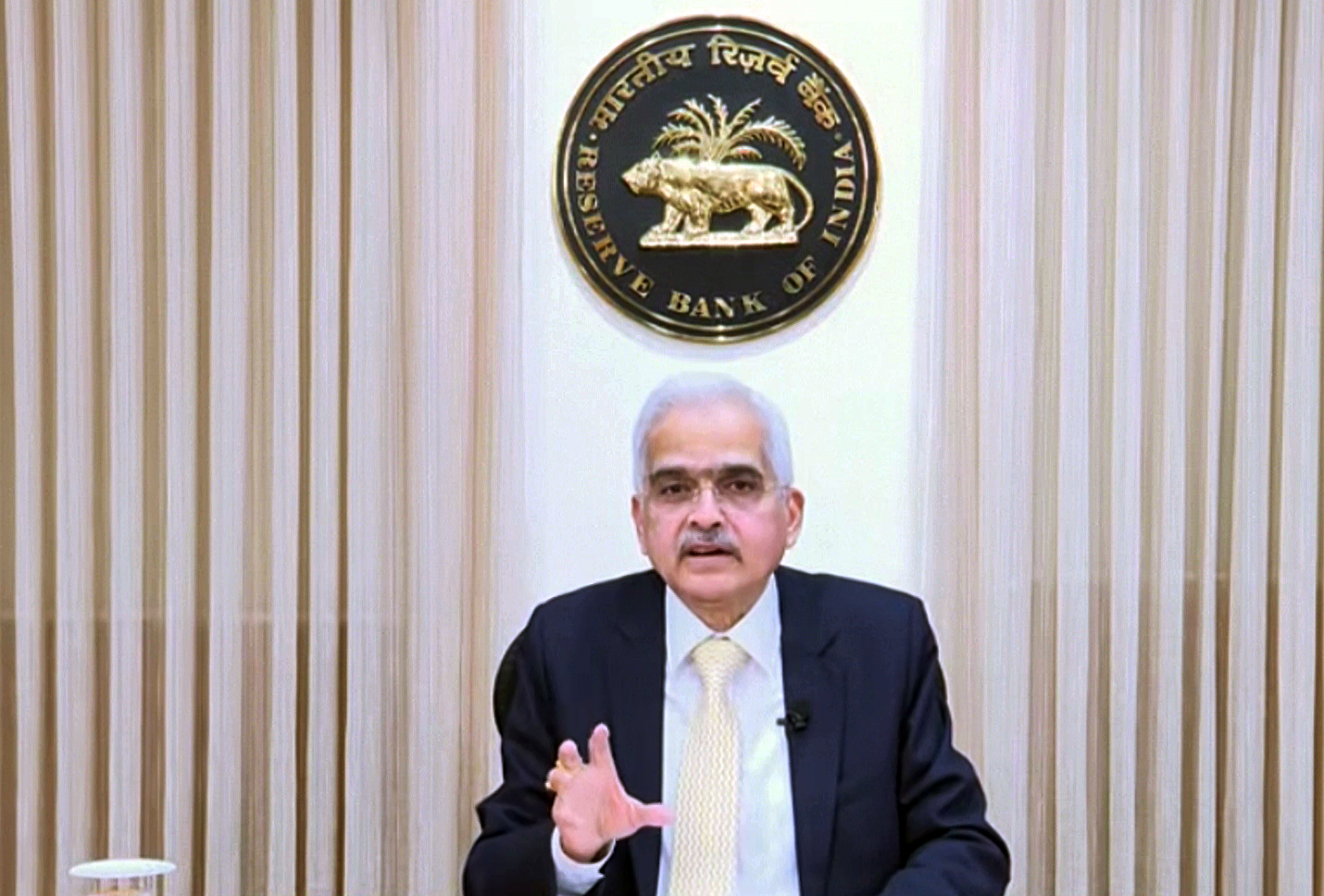

The RBI closely monitors the foreign exchange markets and intervenes only to maintain orderly market conditions by containing excessive volatility in the exchange rate, without reference to any pre-determined target level or band.

(Inputs from ANI)