Major credit rating agencies have revised India’s 2024 growth projections upwards, indicating growing confidence in the nation’s economic potential.

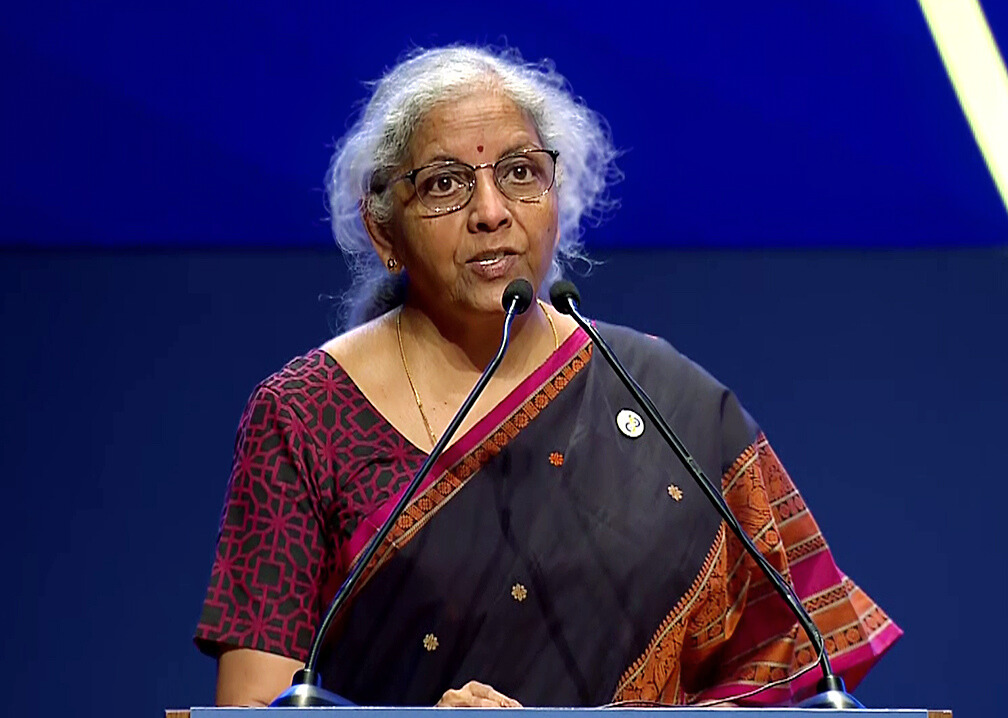

India’s economy witnessed impressive growth rates in the first three quarters of FY 2024, recording 7.8 percent in Q1, 7.6 percent in Q2, and 8.4 percent in Q3. Finance Minister Nirmala Sitharaman recently said that the economy will grow by over 8 per cent in the January-March quarter of 2024.

As the economy continues its upward trajectory, Goldman Sachs has recently revised India’s 2024 growth projections to 6.6%, marking a 10 basis point improvement from its previous forecast.

Earlier this month, S&P, Morgan Stanley, and Moody’s all revised India’s growth projections upward. S&P reworked its projection from 6.4 percent to 6.8 percent, Morgan Stanley revised its forecast from 6.1 percent to 6.8 percent, and Moody’s raised its projection from 6.6 percent to 8 percent for the current fiscal year.

Moody’s, in particular, expects India to emerge as the fastest-growing economy among the G-20 countries, driven by rise in government expenditure and domestic consumption.

The government allocated Rs 11.11 lakh crore as capital expenditure in the interim budget on February 1, 2024. This is an increase of 11.1 percent from the last budget. In the 2023 budget, CAPEX was increased by 33 percent to Rs 10 lakh crore.

“We have revised up 2024’s growth forecast for India due to stronger than expected momentum at the start of the year. An improving global economic environment and an expected gradual easing of domestic financial conditions will support economic activity,” S&P said in statement.

The global analytics firm also raised India’s FY24 forecast to 7.3 percent from 6.9 percent projected earlier. Regarding inflation, the analytics firm projected a decline to 5.1 per cent in FY25 from the earlier estimate of 5.6 percent. India’s inflation is likely to average at 5.7 percent in FY24.

CareEdge Ratings expects India’s GDP to grow at 7.6 percent in FY 2023-24, and around 7 percent in the next financial year.

According to the rating agency, the economic growth in the current financial year was supported by a strong growth in investment demand led by public capital expenditure.

While the agriculture growth is currently subdued, the manufacturing and services sectors are contributing to the overall growth momentum, the rating agency said in a report.

(Inputs from ANI)