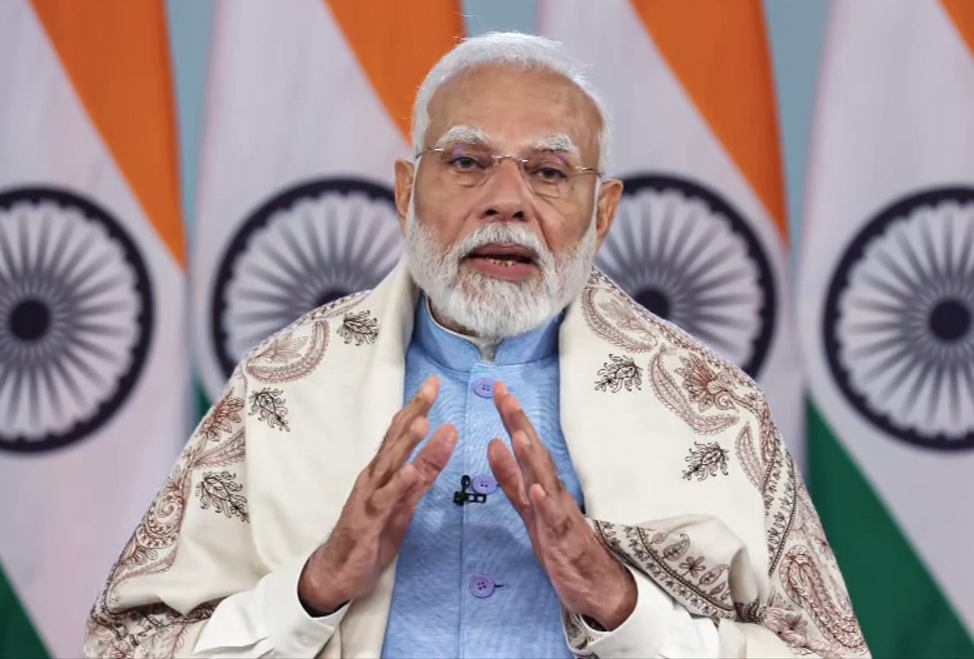

Finance Minister Nirmala Sitharaman on Monday praised the Reserve Bank of India’s (RBI) monetary tightening measures, saying that they have stabilized government securities (G-Sec) yields and boosted investor confidence in the Indian economy.

Speaking at an event commemorating 90 years of the RBI in Mumbai, Sitharaman said, “Inflation management despite monetary tightening pressures and the measures which have been taken for monetary tightening have stabilised the G-sec yields, which are very important for the economy.”

Sitharaman highlighted the RBI’s commitment to safeguarding India’s financial interests and acknowledged the global recognition of its contributions. She cited the Bank of International Settlements’ acknowledgment of the RBI’s role in anchoring inflation expectations through effective communication policies.

In her keynote address, Sitharaman praised the RBI’s resilience amidst economic challenges, particularly during the COVID-19 pandemic. She commended the RBI’s use of both conventional and unconventional policy instruments to ensure liquidity, foster growth, and uphold financial stability.

“The two examples that I can cite, and which stand before us as a classic example, are the moratorium on the loan payments and also the liquidity infusion which happened during that time,” she said.

Sitharaman also threw light on the RBI’s strategic interventions during the Russia-Ukraine conflict, emphasizing its efforts to address inflationary pressures and stabilize forex markets. She also lauded the RBI’s foresight in recognizing the persistent nature of inflation and its timely policy adjustments.

Sitharaman also highlighted the effective management of India’s forex reserves by the RBI and its supervision of the banking sector. She credited the RBI for transforming India’s banking sector from a decade-old balance sheet problem into a current balance sheet advantage.

(Inputs from ANI)